Medical Billing Clearinghouse vs. RCM: Here's the Big Difference

/Searching for an eye care revenue cycle management (RCM) partner and medical billing clearinghouse to manage coding, billing, vision plan and insurance claim submission, accounts receivable, denied and rejected claims, and collections for your practice? Not sure what the difference is between a clearinghouse and RCM?

Perhaps the most important distinction is that a clearinghouse doesn’t replace RCM; they work together. While many clearinghouses offer RCM services, there are significant differences you may not be aware of before you sign on the dotted line.

Let’s look at common questions and answers and why investing in both is critical for a healthy return on your business investment.

What is an Optometric Medical Billing Clearinghouse?

A clearinghouse is an intermediary or middleman (a sender and receiver) that regularly transmits secure, HIPAA-compliant electronic medical claims and financial information from eye care providers to single or multi-payers in batch transactions. Payers include Medicare, Medicaid, Managed Care, private insurances, and other third-party payers.

The clearinghouse takes the e-claims you create within your practice management billing software and verifies the claims are complete and comply with payer billing requirements. The clearinghouse then converts the claims to compliant electronic transactions and sends them electronically to insurance payers using Electronic Data Interchange (EDI).

Why Use a Clearinghouse for Medical Claims Billing?

Using a clearinghouse expedites reimbursements, reduces errors, and increases revenue by consolidating electronic claim submissions. A clearinghouse gives medical billers and billing managers access to thousands of insurance payers, across different states, from a single location.

The average error rate for paper medical claims is 28%, whereas a good clearinghouse reduces that rate to 2-3%, reports ClearingHouses.org.

If you want to speed up the process, choose a clearinghouse that integrates with your eye care practice management software so you can easily manage patient and insurance billing with built-in edit checks.

Pro Tip: Need a refresher course in common medical billing and insurance terms? Check out our blog, Common Medical Billing and Insurance Terms You Should Know.

What is Revenue Cycle Management (RCM) in Optometry and Ophthalmology?

Complete RCM is a financial process that manages claims processing, payment, and revenue generation.

Optometric billing services and RCM work with your medical billing clearinghouses to streamline and simplify administrative and clinical functions so you can capture, manage, and collect patient service revenue. In other words, RCM keeps your practice moving toward growth rather than falling behind.

The financial health of any eye care practice depends on an efficient end-to-end revenue cycle management process that works side-by-side with your clearinghouse. Every practice needs a steady stream of revenue to remain in business.

We specialize in optometry and ophthalmology-focused billing services at Fast Pay Health, whereas clearinghouses offer broad support for many different specialties. Our billing team tracks all claims we submit electronically through clearinghouses and ensure that insurance payers accept the claims. If we notice a rejection, we promptly and manually fix the errors to ensure timely insurance receivables.

Advantages to Using Revenue Cycle Management Services

Keeping up with evolving optometry and ophthalmology billing and coding rules, insurance payer regulations, complicated EDI processes, and monitoring and acting on denied and rejected claims is time-consuming and eats away at your cash flow.

Managing claim denials and rejections, submitting claims, posting payments, and staying on top of AR issues start to compound if you take on too much, and you will find yourself buried under a pile of paperwork.

On average, healthcare providers will see a 5–10% increase in net collections when they outsource their revenue cycle management. There are many advantages when you outsource your optometric billing.

What Types of Optometric Billing and RCM Solutions Are Critical?

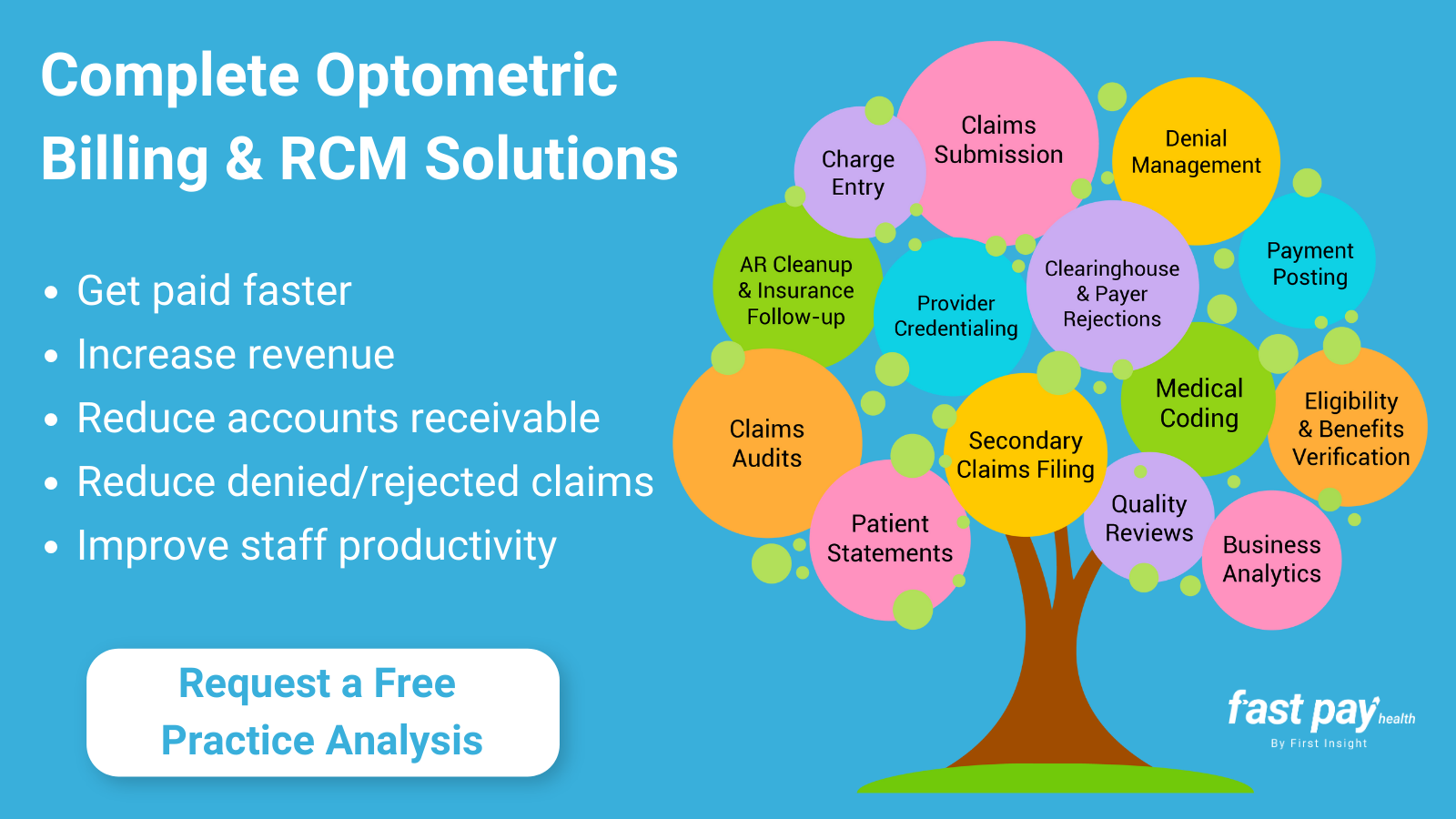

Below are critical revenue cycle management solutions that help you get paid faster, increase revenue, and improve staff productivity.

Eligibility and Benefits Verification: Patient insurance eligibility and benefits verification is one of the easiest ways to maintain clean claims, but verification is often the most neglected process. You must ensure insurance data is correct by verifying plan coverage and the amount a patient may owe (e.g., co-pays, co-insurance, and deductibles).

Provider Credentialing: RCM services simplify the provider credentialing process by reviewing documentation to determine the provider’s participation status in the health plan, then submitting and tracking provider credentialing applications based on insurance plan requirements.

Charge Entry: The best optometric RCM solution takes the worry out of entering error-free insurance data before insurance claims are filed. Accurate charge entry is crucial so your practice can collect maximum reimbursements, decrease payment denials, and increase profitability.

Medical Coding: Certified medical coders have a good understanding of anatomy and physiology, disease process, and clinical procedures, which allows them to apply the correct billing codes and modifiers to medical claims. Also, when you outsource your medical billing and RCM services, you don’t have to worry about keeping up with certifications, staff vacations, unplanned sick days, turnover, or costly re-training.

Electronic and Paper Claim Submission: While every practice will experience claim rejections and denials, knowing how to prevent those rejections in the first place is the solution to receiving revenue quicker. RCM and billing partners ensure your medical claims are clean and free from errors before they submit them to insurance companies—delivering a consistent and positive cash flow for your practice.

Clearinghouse and Payer Rejections: Are you spending too much time verifying that the insurance payer accepts the electronic claims you submit? RCM optometric billing consultants track all claims the practice submits electronically through a clearinghouse. If they notice a rejection, they promptly fix the errors to ensure timely receivables.

Daily Insurance Payment Posting: By posting remits within 24-48 hours, you can move the balance to secondary insurance and bill that much quicker. RCM optometric billing consultants post payments that come in through Electronic Remittance Advice (ERA) and standard paper Explanation of Benefits (EOB) directly into your practice management system, so you have accurate and up-to-date accounts.

Secondary Claims Filing: If a patient has secondary insurance, you can run into timely filing denials. Many payers require you to bill a secondary carrier within a specific period after you receive payment from the primary insurance payer. Or, if there was a balance left for the patient to pay, it becomes increasingly difficult to collect payments the longer it’s been since the patient’s visit.

Denied and Rejected Claims Management: Researching unpaid or denied claims is time-consuming. Once a claim is denied or rejected, most insurers set a deadline to contest the denial. You must promptly review all rejected or denied claims to increase your cash flow. RCM services analyze all unpaid claims and EOBs and take the necessary steps to correct and reprocess rejected claims to recover the maximum payment possible.

AR/Aging Claims Clean Up and Insurance Follow-up: Accurate information directly relates to you receiving reimbursements—claims get paid faster. RCM specialists analyze unpaid claims and then take the necessary steps to recover the amount due. Outsourcing RCM services reduces the hours your staff spends tracking down payments with insurance companies, so you can see more patients and focus on other operational tasks.

Claims Auditing: Avoid delays in reimbursements with proactive medical claim audits—they are vital to benefit-cost management. Audits will help you determine which RCM processes require improvements and corrections to improve your practice's financial health. The best RCM services will review AR aging claims daily to see why open balances are still outstanding.

Processing Patient Statements: Are you having a difficult time keeping up with printing and mailing statements to your patients? Reduce expenses, boost your revenue, and eliminate the time-consuming task of in-house printing and mailing. The quicker you send out patient statements, the faster you get paid.

Quality Reviews: Are you cross-checking every revenue cycle management process to locate and correct a problem, then checking to see that what you did works? RCM quality review teams monitor every step of the revenue cycle management process.

Business Analytics to Track Results: Comprehensive reports analyze the activity and work completed, and they help measure and track your results over time. Analytics provide insight into business strategies that will help you move your practice forward and improve your financial performance.

Ready to Experience the Positive ROI of a Complete Optometric Billing and RCM Solution?

The Fast Pay Health end-to-end revenue cycle management approach is to triple-check everything so that you see a consistent return on your investment. Our service goes far beyond processing insurance and vision plan claims, and we work with ANY ophthalmology and optometry EHR or practice management software.

Get started today, request a free practice analysis, and find out how we deliver complete eye care billing solutions tailored to your individual practice.